TaxMaster

The Tax Industry’s Leading Audit Execution Software

Overview

TaxMaster is our premier, state, and local tax audit execution software used by the city, county, and state agencies.

In use by thousands of field auditors, TaxMaster actively supports over 30 tax types and has been developed and enhanced to meet the specialized needs of field auditors to help organizations conduct audits that maximize time and quality.

Industry Challenge

Limited knowledge and documentation of your homegrown audit system.

The system relies heavily on one person.

Homegrown systems are frequently written in an older, unsupported version of some tool or language.

ICON | Homegrown systems don’t always handle all the tax types.

Functionality

Adaptability

Innovation

1500+

Users can conduct audits every da

30+

Tax types are actively supported by TaxMaster

100,000s

Of audits completed

25+

Years of experience.

Key Features & Functions

- Supports multiple types of audit and per tax type methodologies

- Detailed, statistical, and stratified statistical.

- Custom templates.

- Six integrated, multi-format tools.

- Audit report, whether standard or customized templates were utilized.

- Multiple data import channels for electronic records.

- Time-saving features for keying data when electronic records are not available.

- Attach critical external files of any type obtained during an audit, including DB files and PDFs.

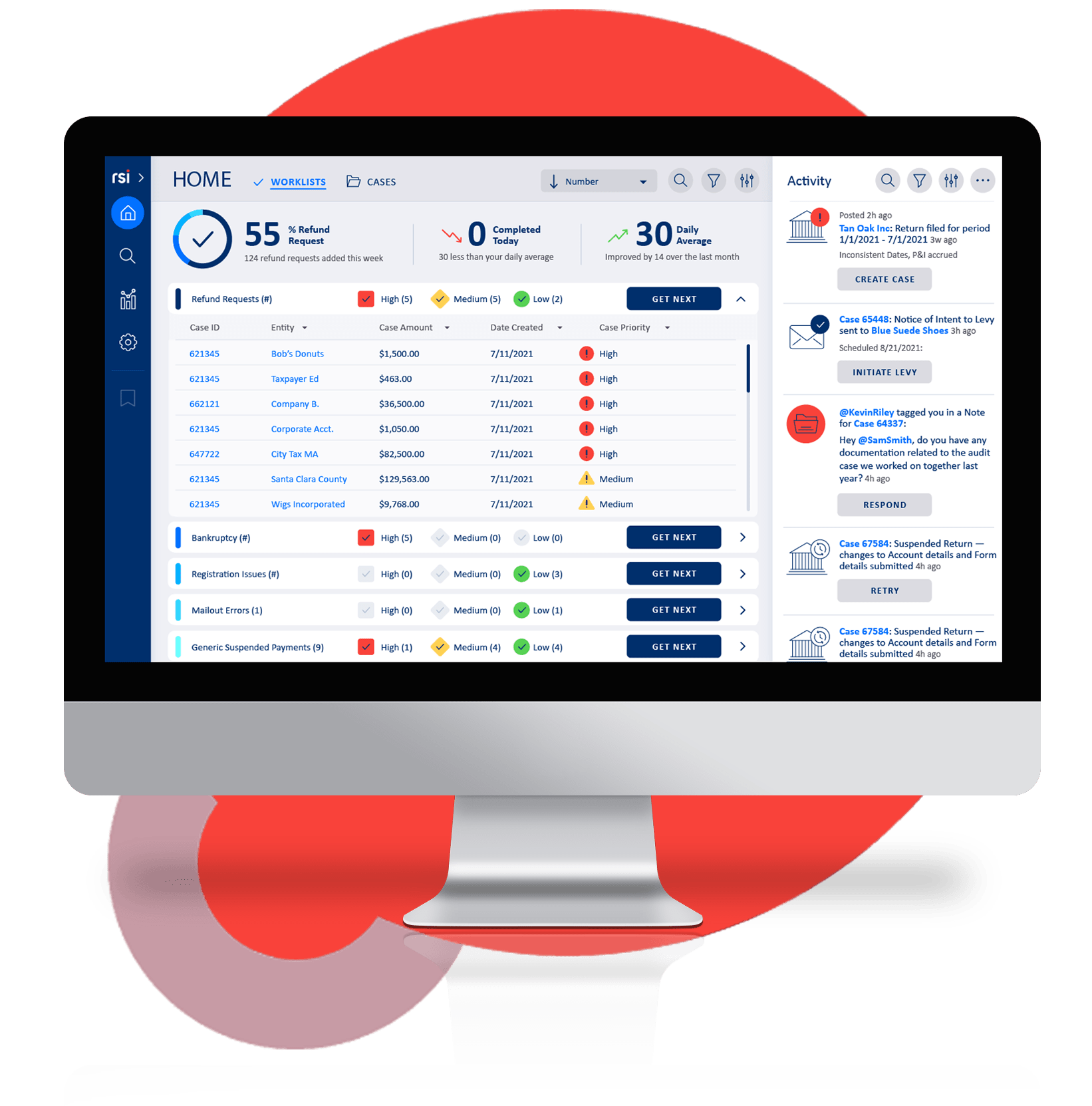

- Easily integrates with RSI’s case management system or other, 3rd-party systems.

TaxMaster toolset meets virtually every detailed audit function

needs out of the box for all tax types.

Easy and seamless configuration

With TaxMaster, configuration, and maintenance of tax types, reporting requirements, taxing jurisdictions, current and historical rates for state, county, and local taxes are made easy through simple configuration for any state, county, or local tax structure.

As tax, penalty, or interest rates (or calculations) change, the configuration settings are managed centrally and distributed to auditors automatically.

Supports multiple types

of audit methodologies

RSI offers full SRS Audit support through its Statistical Sampler system, which easily integrates with TaxMaster.

Statistical Sampler

RSI’s Statistical Sampler allows you to perform a Stratified Random Sample (SRS) audit. Its wizard-based approach guides an auditor through a step-by-step process to conduct an SRS audit.

This way, the auditor performs the audit autonomously without (or with minimal) assistance from a Computer Auditing Specialist (CAS).

To ensure all SRS audits adhere to the agency’s process and procedure, Statistical Sampler allows

administrators to establish and maintain the set of accepted sampling parameters, confidence intervals, and other options in a central location.

Detailed, Block Sample and Stratified Random Sample (Statistical).

Multiple methodologies per tax type.

Tax-type specific methodologies.