TaxMaster

The Tax Industry’s Leading Audit Execution Software

Overview

TaxMaster is our audit workpapers solution that provides tools and templates to drive audit efficiency and consistency.

Drives efficiency of Field Auditors through a set of six, tightly integrated tools specifically designed for field tax audits and promotes consistency across audits, auditors, and tax types, with a software solution that supports over 30 tax types.

Industry Challenge

Auditors spending more time doing data entry vs performing the audit.

Multiple, disparate applications or tools that aren’t integrated causing extra work on the part of auditors and audit managers.

End of life of current system(s) / legacy technology.

Inconsistent workpapers across field auditors for audit managers.

We assist audit managers, supervisors, and auditors to complete audits with maximum efficiency and productivity by providing enhanced:

Functionality

Adaptability

Innovation

Work with an audit execution tool specifically built to support field auditors across all tax types.

1500+

Users can conduct audits every day

30+

Tax types are actively supported by TaxMaster

100,000s

Of audits completed

25+

Years of experience.

Key Features & BENEFITS

- Flexible, easy to configure templates.

- Multiple ways to import data for electronic records.

- Six tightly integrated, specialized editors for different file types.

- Time-saving features for keying data.

- Comprehensive audit reports, whether you used standard or customized templates.

- Attach any files types obtained during an audit.

- PDF-packager.

Key Features & Functions

- Supports multiple types of audit and per tax type methodologies

- Detailed, statistical, and stratified statistical.

- Custom templates.

- Six integrated, multi-format tools.

- Audit report, whether standard or customized templates were utilized.

- Multiple data import channels for electronic records.

- Time-saving features for keying data when electronic records are not available.

- Attach critical external files of any type obtained during an audit, including DB files and PDFs.

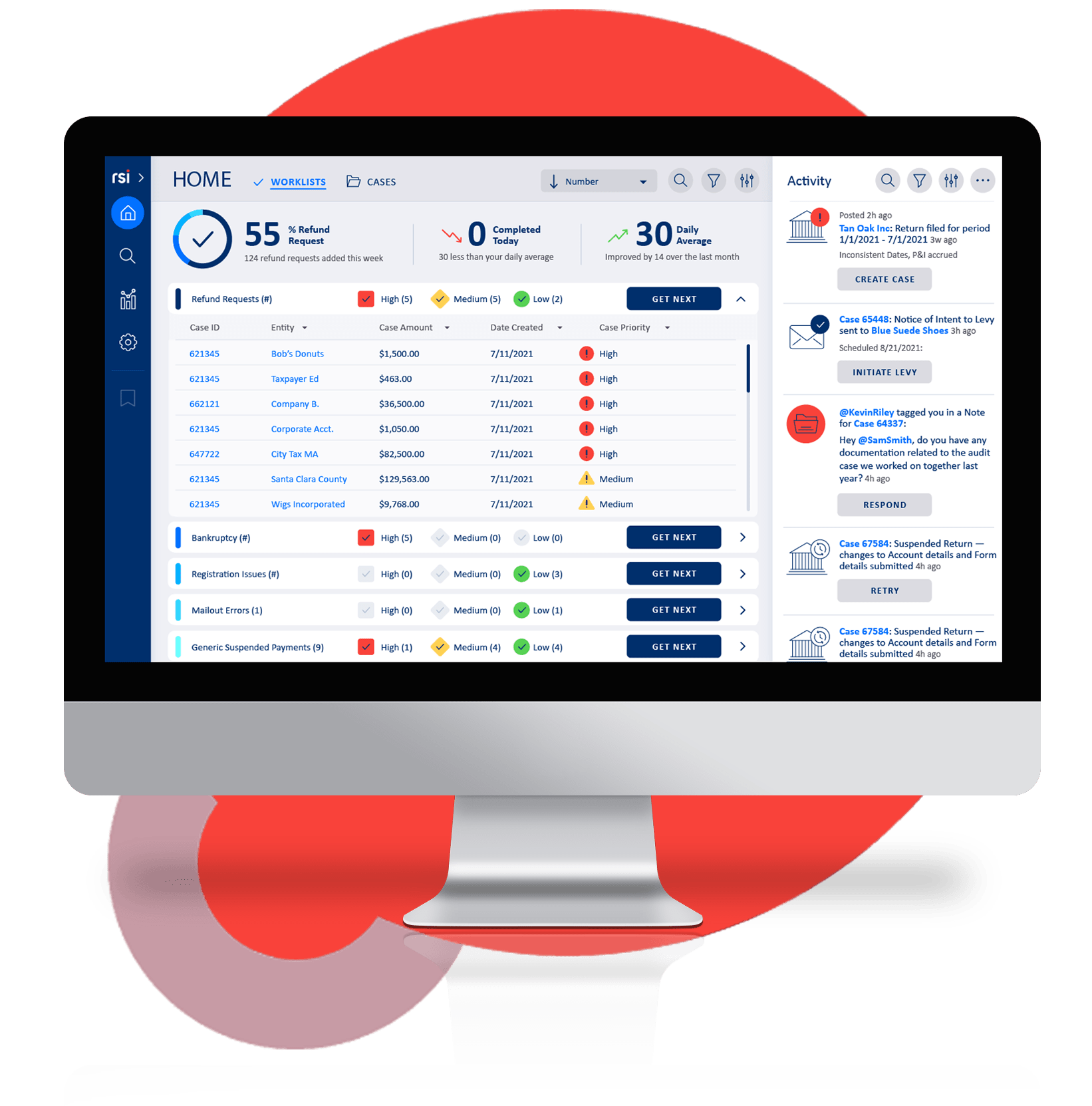

- Easily integrates with RSI’s case management system or other, 3rd-party systems.

TaxMaster drives audit execution and supports the field auditor every step of the way with the tools they need.

Easy and Seamless Configuration

With TaxMaster, configuration, and maintenance of tax types, reporting requirements, taxing jurisdictions, current and historical rates for state, county, and local taxes are made easy through simple configuration for any state, county, or local tax structure.

As tax, penalty, or interest rates (or calculations) change, the configuration settings are managed centrally and distributed to auditors automatically.

Supports Multiple Types of Audit Methologies

TaxMaster has tax-type specific methodologies and supports multiple audit methodologies per tax type. It allows you to use any combination of methodologies desired to complete an audit.

Detailed Audit

Sampling Audit

Stratified Random Sample

(Statistical Sampling)

Supports Multiple Types of Audit Methologies

RSI offers full SRS Audit support through its Statistical Sampler system, which easily integrates with TaxMaster.

Statistical Sampler

RSI’s Statistical Sampler allows you to perform a Stratified Random Sample (SRS) audit. Its wizard-based approach guides an auditor through a step-by-step process to conduct an SRS audit.

This way, the auditor performs the audit autonomously without (or with minimal) assistance from a Computer Auditing Specialist (CAS).

To ensure all SRS audits adhere to the agency’s process and procedure, Statistical Sampler allows

administrators to establish and maintain the set of accepted sampling parameters, confidence intervals, and other options in a central location.

Detailed, Block Sample and Stratified Random Sample (Statistical).

Multiple methodologies per tax type.

Tax-type specific methodologies.